The Escalating Crisis in U.S. Health Insurance: Why Families Are Paying More for Less—and the Path to True Wellness

By Dr. Stefano Sinicropi | Board-Certified Orthopedic Spine Surgeon | Founder of HyperCharge Health & HyperCharge Clinics | President of Midwest Spine and Brain Institute

Disclaimer: This blog is for informational purposes only and is not intended as medical advice. The treatments described should only be considered after a consultation and under the direct supervision of a qualified medical expert.

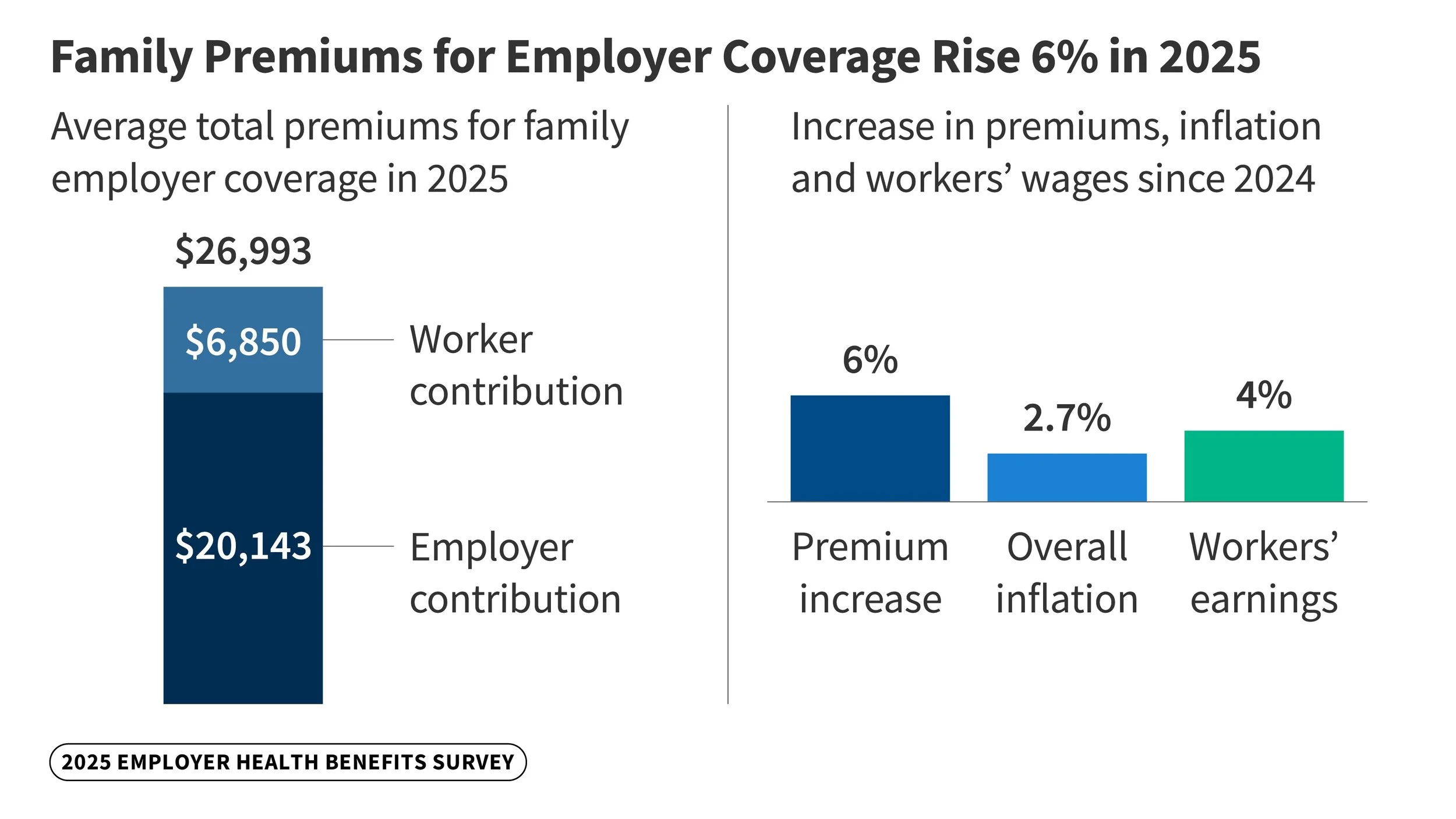

Health insurance costs in the United States continue to spiral upward, placing immense strain on individuals, families, and employers alike. For a family of four, the average annual premium for employer-sponsored coverage hit $26,993 in 2025, a 6% increase from the prior year and part of a 26% rise over five years [1]. Employees contribute roughly $6,850 on average, but when deductibles—averaging $1,886 for individuals and often higher for families—and out-of-pocket maximums exceeding $3,000 for most are factored in, total expenses can soar toward $50,000 in unsubsidized scenarios, particularly in high-cost states like Alaska or Vermont [2][3]. In the ACA marketplace, unsubsidized premiums for a family of four averaged $17,244 annually in 2025, based on monthly rates of about $1,437, with projections for a 26% hike into 2026 [4][5]. These burdens compound with medical debt affecting 41% of adults and half unable to cover a $500 emergency without borrowing [6].

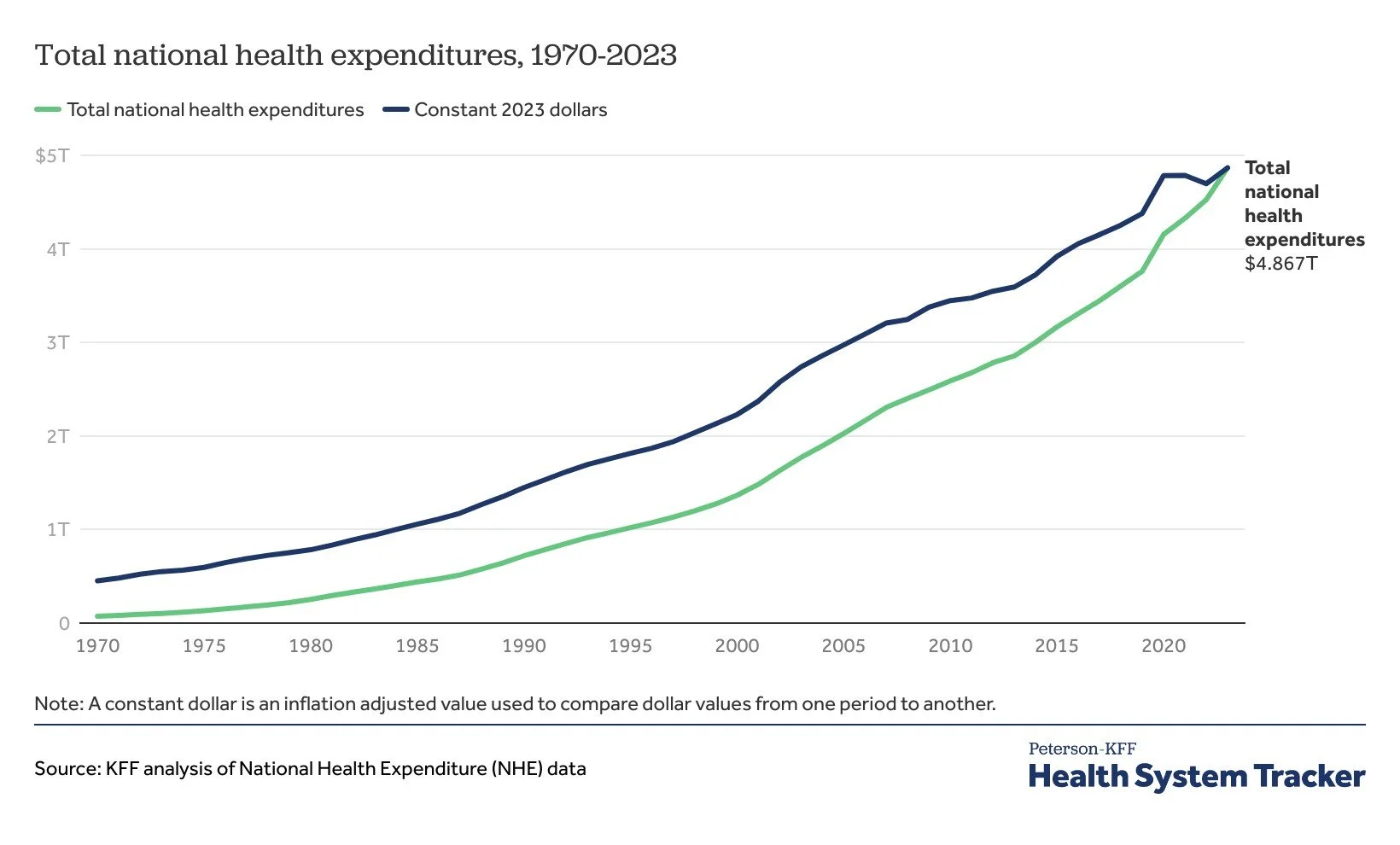

This financial pressure reflects deeper systemic flaws: administrative inefficiencies, profit-driven models, and a focus on acute care that neglects preventive and holistic wellness. U.S. healthcare spending reached $4.9 trillion in 2023—17.6% of GDP and $14,570 per person—yet outcomes lag behind other nations, with chronic diseases driving 90% of costs while prevalence rises unabated [7][8]. As families and employers question the value of these premiums, many are turning to alternatives like direct primary care (DPC) and integrative clinics, or even opting out entirely. This blog explores these trends, delves into the specific challenges of ACA exchanges and employer-sponsored plans, highlights innovative approaches like biohacking and regenerative medicine often excluded from coverage, and proposes reforms centered on health savings accounts (HSAs) to empower consumers.

Decoding the Premium Explosion: Trends and Drivers in Employer-Sponsored and ACA Coverage

Health insurance premiums have consistently outpaced wage growth and inflation, eroding affordability across both employer-sponsored and individual markets. For employer-sponsored family coverage, premiums grew 5.5% to $26,993 in 2025, following a stagnant 0.1% growth in 2024 amid post-pandemic adjustments [1]. Workers' contributions remained at $6,850, but employers bore the brunt at $20,143 on average [1]. Key drivers include prescription drug price surges (8.6% in 2023), hospital consolidations inflating charges, and chronic care demands, with 36% of large employers attributing rises to GLP-1 drugs like Wegovy [1][7]. Notably, premiums for small firms (3-199 workers) averaged $26,054 in 2025, up from $16,977 in 2020—a staggering 53% increase that highlights the disproportionate burden on smaller operations [9].

Table 1 illustrates premium trends for employer-sponsored family coverage:

2020

Average Family Premium ($): 21,342

Annual Increase (%): -

Worker Contribution ($): 5,588

2021

Average Family Premium ($): 22,221

Annual Increase (%): 4.1

Worker Contribution ($): 5,969

2022

Average Family Premium ($): 23,968

Annual Increase (%): 7.9

Worker Contribution ($): 6,106

2023

Average Family Premium ($): 25,572

Annual Increase (%): 6.7

Worker Contribution ($): 6,575

2024

Average Family Premium ($): 25,585

Annual Increase (%): 0.1

Worker Contribution ($): 6,850

2025

Average Family Premium ($): 26,993

Annual Increase (%): 5.5

Worker Contribution ($): 6,850

(Source: KFF Employer Health Benefits Surveys, 2020–2025 [1].)

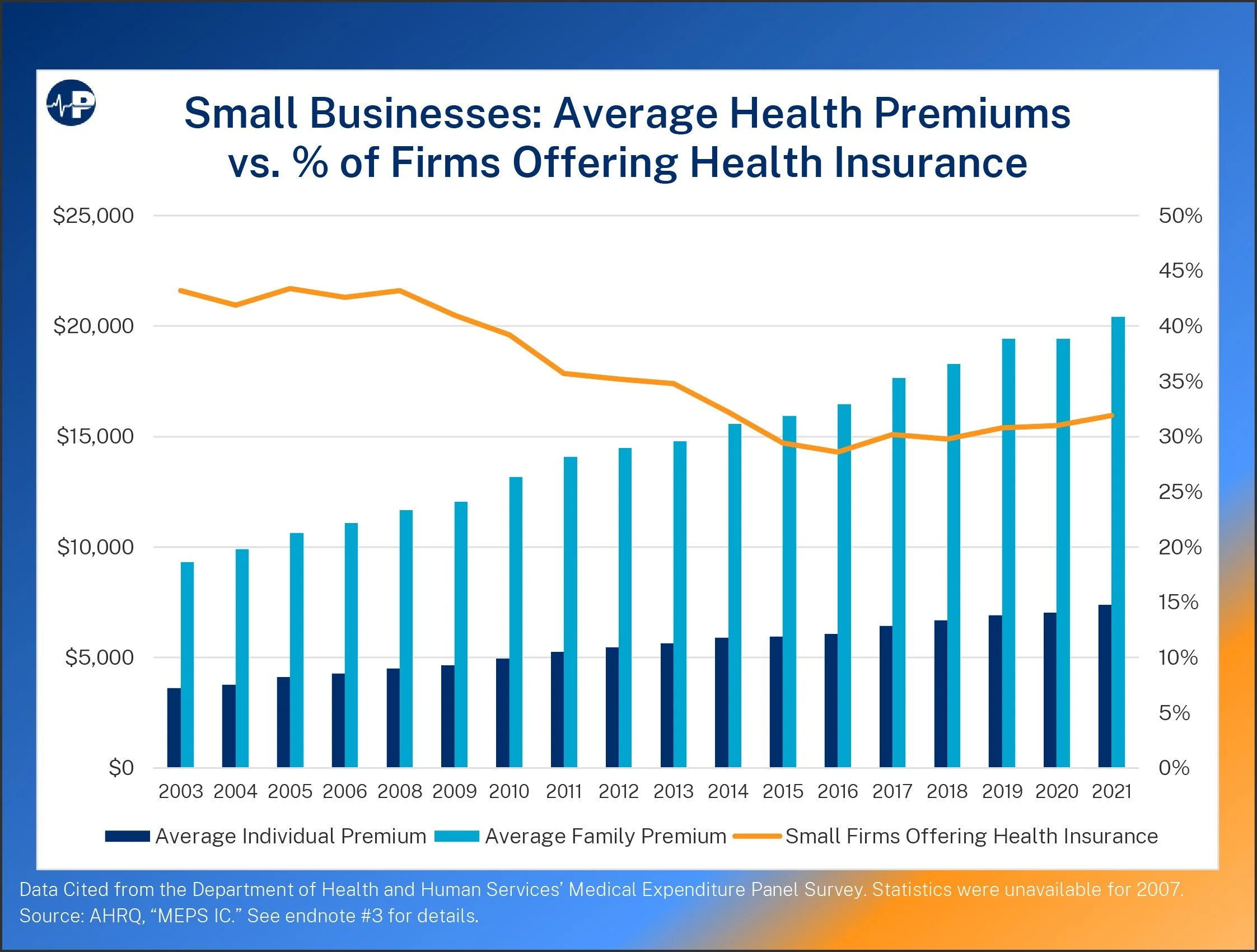

Employers, particularly small businesses, are increasingly strained. In 2025, small firms reported average family premiums of $26,054, with worker contributions at $8,889—higher than the overall average due to less negotiating power with insurers [1][9]. A recent NFIB report describes the small-group market as in a "death spiral," with 98% of small business owners concerned about affordability [10]. Nearly one-third of small businesses drop health coverage from one year to the next, often citing rising costs as the primary reason [11]. For instance, the share of firms with 3-9 workers offering coverage fell to 35% in 2025 from higher rates pre-pandemic, as premiums have outstripped revenue growth [1][12]. Employers predict health benefit costs will rise 6.5% on average in 2026, the highest in 15 years, even after plan adjustments, with some forecasting 9% increases [13][14]. This has led to strategies like higher deductibles or narrower networks, but many small businesses are simply opting out, pushing employees toward ACA exchanges or salary adjustments in lieu of benefits [11][15].

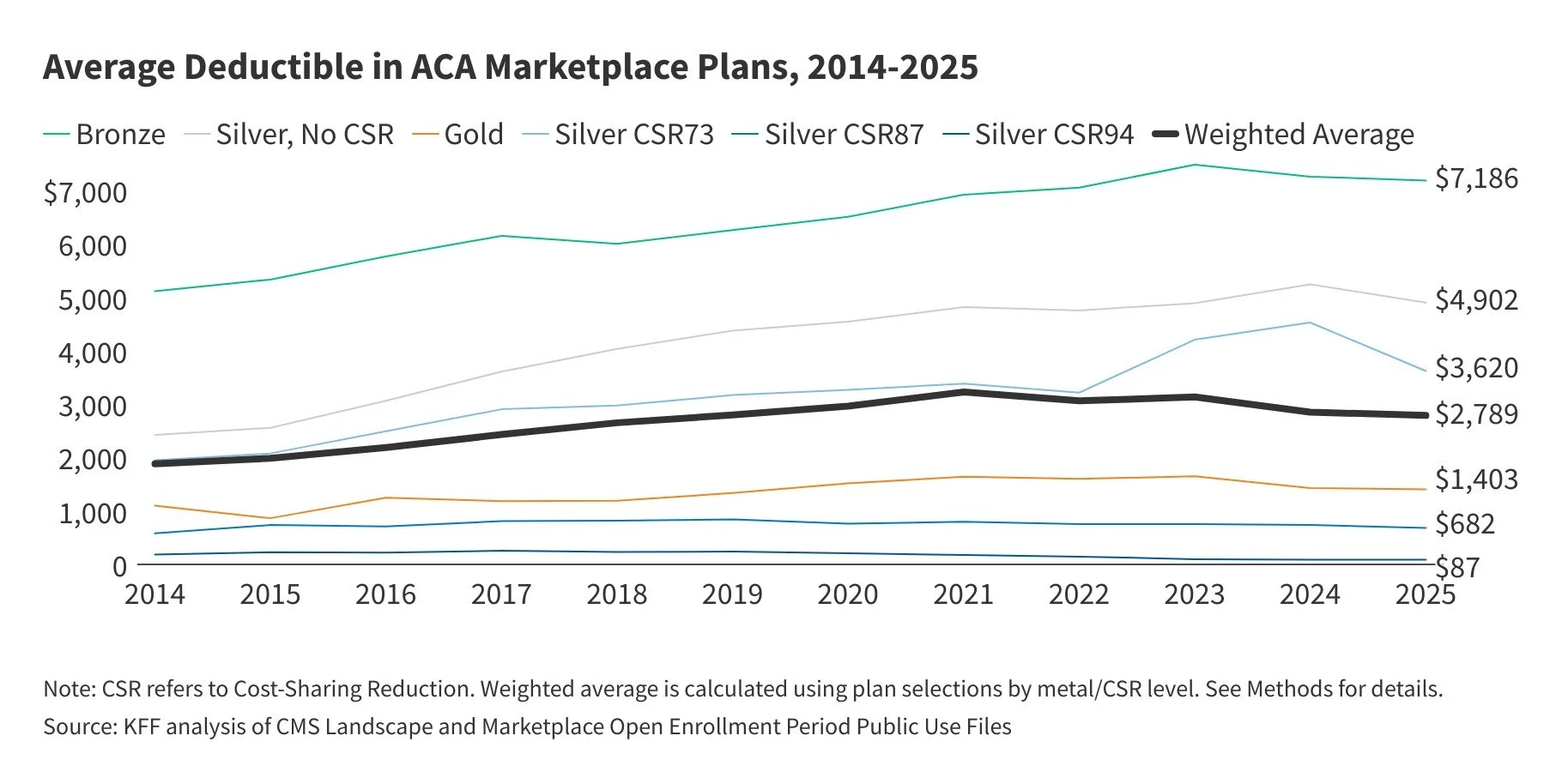

The ACA marketplace exacerbates these issues for those without employer coverage. Unsubsidized families face volatile costs: in 2025, average premiums for a family of four were $17,244, but in states like West Virginia or Wyoming, they exceeded $40,000 before deductibles [3][4]. While enhanced subsidies kept net premiums stable at around $888 for eligible enrollees in 2025, their expiration at year-end means unsubsidized premiums will surge 26% on average in 2026, pushing many families' net payments from $888 to $1,904—a 114% increase [4][5][16]. For a family earning $130,000 (404% of the federal poverty level), monthly premiums could jump from $921 to $1,992 [17]. In high-cost areas, unsubsidized family plans already approach $30,000–$50,000 annually when including deductibles averaging over $7,000 for bronze plans [2][18]. Factors like rising utilization (6.1% growth) and drug costs contribute, but the end of subsidies could leave 1.5 million more uninsured in 2026 [7][19].

These escalations create a feedback loop: delayed care exacerbates chronic conditions, further driving costs. For healthy families and small businesses, the proposition feels increasingly untenable—paying thousands for coverage that may not align with their needs.

The Employer Dilemma: Rising Costs and Declining Coverage

Employers are not immune to the premium surge, with costs directly impacting bottom lines and workforce strategies. In 2025, the total health benefit cost per employee averaged around $15,000–$16,000 for large firms, but small businesses faced higher proportional burdens due to fixed administrative fees and less favorable risk pools [1][20]. Mercer's survey indicates employers anticipate a 6.5% rise in 2026, even after cost-saving measures like wellness programs or high-deductible plans [13]. For small firms, this translates to premiums consuming 10–15% of payroll, up from lower shares a decade ago [10].

Data shows a clear trend: as premiums rise, coverage offerings decline, especially among small businesses. The percentage of firms with 3-199 workers offering health benefits dropped to 56% in 2025 from 59% in 2020, with the smallest (3-9 workers) at just 35% [1]. A JPMorgan Chase study found that nearly 33% of small businesses discontinued coverage year-over-year, often replacing it with salary increases that fail to keep pace with healthcare inflation [11]. In the current economic environment—marked by inflation at 2.7% and wage growth at 4%—small businesses cite premiums as a top barrier to hiring and retention [1][21]. NFIB reports 98% of owners view costs as "critical," leading to a "death spiral" where healthy groups exit, leaving sicker pools and higher rates [10].

Table 2 highlights employer premium contributions by firm size in 2025:

Small (3-199)

Average Family Premium ($): 26,054

Employer Contribution ($): 17,165

Worker Contribution ($): 8,889

% Offering Coverage: 56%

Large (200+)

Average Family Premium ($): 27,280

Employer Contribution ($): 21,053

Worker Contribution ($): 6,227

% Offering Coverage: 99%

All Firms

Average Family Premium ($): 26,993

Employer Contribution ($): 20,143

Worker Contribution ($): 6,850

% Offering Coverage: 65%

(Source: Adapted from KFF Employer Health Benefits Survey, 2025 [1].)

This disparity pushes employees from small firms toward ACA exchanges, where unsubsidized costs are prohibitive, or leaves them uninsured—contributing to the 8% national uninsured rate [6]. As Dr. Stefano Sinicropi observes, this system fails to deliver value, prompting a reevaluation of how we structure health benefits.

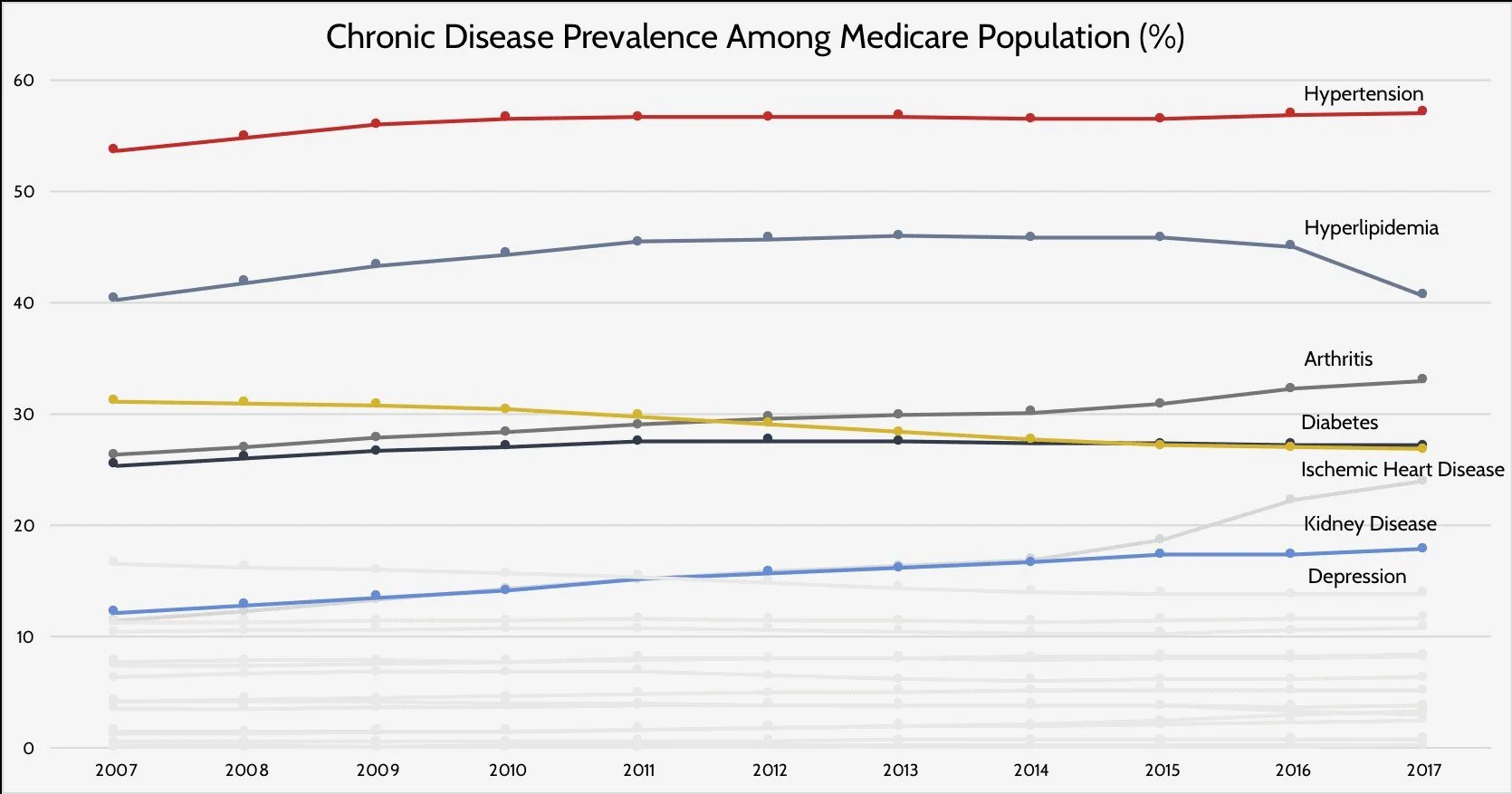

The Chronic Disease Epidemic: A Failing Investment Despite Trillions Spent

Despite trillions invested, chronic diseases afflict 60% of Americans, with 40% managing multiple conditions [8][22]. Obesity affects 42% of adults, hypertension 31.6%, diabetes 12.5%, and asthma 11%, with Alzheimer's costs hitting $360 billion in 2024 after deaths doubled since 2000 [23]. Projections warn of heart disease and stroke expenses reaching $2 trillion by 2050 [23]. Among the Medicare population, prevalence has steadily increased: hypertension rose from 55% in 2007 to 58% in 2017, diabetes from 28% to 31%, and kidney disease from 14% to 19% [24].

Internationally, the U.S. spends twice per capita but trails in life expectancy and chronic outcomes [25][26]. This inefficiency stems from fragmented care, where traditional Western medicine excels in acute interventions but falters in chronic management and prevention, often limiting visits to 15 minutes amid administrative burdens [27].

Table 3 details chronic disease burdens:

Obesity

Prevalence (% of Population): 42% (adults)

Annual Cost (Billions $): 173

Trend: Increasing

Diabetes

Prevalence (% of Population): 12.5%

Annual Cost (Billions $): 413 (2022)

Trend: Rising, 98M prediabetic

Heart Disease

Prevalence (% of Population): Leading cause of death

Annual Cost (Billions $): 233 (healthcare)

Trend: Projected $2T by 2050

Cancer

Prevalence (% of Population): 1.8M new diagnoses/year

Annual Cost (Billions $): >240 by 2030

Trend: Stable but costly

Alzheimer’s

Prevalence (% of Population): 7M affected

Annual Cost (Billions $): 360 (2024)

Trend: Deaths doubled 2000–2021

(Source: CDC Fast Facts on Chronic Conditions, 2025 [23].)

National health expenditures reached $4.867 trillion in 2023, up from $74.1 billion in 1970 when adjusted for inflation [7]. This growth—fueled by hospital care (31%), physician services (20%), and drugs (8%)—highlights a system prioritizing treatment over prevention [28].

This mismatch fuels dissatisfaction, with 30% rating their plans "fair" or "poor" [6]. Healthy individuals, in particular, see little return on investment, prompting exploration of alternatives.

Underinsurance in Disguise: The Gap in Coverage for Innovative Therapies

Even with premium payments, many remain effectively underinsured because traditional plans exclude emerging fields like biohacking and regenerative medicine—approaches that enhance wellness, quality of life, and longevity but are deemed "experimental" [29][30][31][32]. Biohacking, involving personalized optimizations through diet, wearables, supplements, peptides, light therapies, oxygen therapies or advanced techniques like genetic testing, aims to boost cognitive function, energy, immune resilience, and longevity [33][34][35][36][37]. Studies show it reduces oxidative stress, prevents age-related diseases like diabetes and cardiovascular issues, and extends healthspan by promoting behaviors like reduced red meat intake or brain games for cognition [38][39][40][41]. Yet, insurance rarely covers it; genetic testing may be reimbursed if medically necessary, but broader hacks like implants or personalized medicine services are out-of-pocket [42][43][44][45].

Regenerative medicine—using stem cells, platelet-rich plasma (PRP), or tissue engineering—targets chronic conditions by repairing damaged tissues, alleviating symptoms, slowing progression, and potentially curing issues like osteoarthritis or neurological disorders [46][47][48][49][50][51][52][53][54]. It improves mobility, reduces pain, and lessens reliance on long-term medications or surgeries, enhancing quality of life for conditions like stroke, wound healing, or hair loss [55]. However, coverage is limited; stem cell therapies and PRP are often denied as experimental, with exceptions like Tricare for PRP or specific bone marrow transplants [56][57][58][59][60][61][62][63][64].

This exclusion leaves patients "underinsured," paying top premiums for plans that ignore proactive, longevity-focused care. As Americans seek wellness beyond pills and procedures, these gaps drive the shift to cash-pay models, especially as ACA and employer plans prioritize conventional treatments.

Opting Out: The Rise of Alternatives Amid Systemic Failures

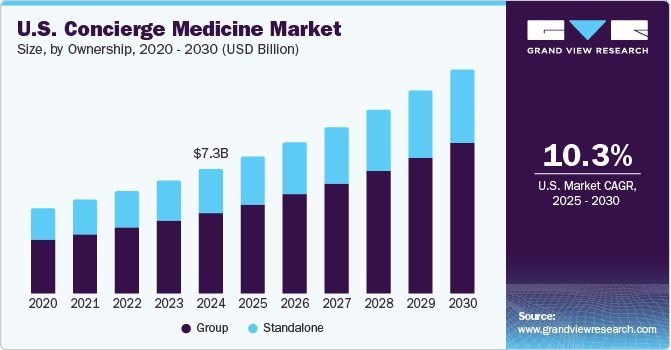

With 8% uninsured (27 million) and many more underinsured, alternatives are booming [6]. DPC practices, now over 2,600, offer flat fees ($50–$150/month) for unlimited, personalized care with smaller panels (average 413 patients), ensuring same-day access and comprehensive strategies [65][66][67]. The integrative medicine market, valued at $34.4 billion in 2024, grows at 23.9% CAGR, blending conventional and alternative therapies for root-cause resolution [68]. The concierge medicine sector, encompassing DPC, is projected to reach $7.3 billion by 2030, with a 10.3% CAGR from 2025 [69].

These models bypass bureaucracy, focusing on prevention and extended consultations—ideal for chronic management and "I don't feel well" cases where traditional care falls short. Concierge medicine sees 9% of family physicians participating, with high patient satisfaction [70][71]. However, affordability remains a barrier; not everyone can pay upfront, underscoring the need for hybrid systems where integrative handles wellness and chronic care, while traditional excels in acute events like surgeries or emergencies.

A Reformed Vision: Universal HSAs and Catastrophic Coverage

To address these inequities, a universal HSA system—annually funded for all Americans (e.g., $5,000–$15,000 per person, income-adjusted)—paired with catastrophic insurance could empower choice, reduce premiums, and cover diverse services like DPC, biohacking, or regenerative therapies [72]. This consumer-driven model aligns incentives with prevention, cutting administrative waste.

Prominent physicians have echoed similar ideas. Dr. Scott Atlas, a radiologist and Hoover Institution senior fellow, advocates for universal HSAs in his writings and testimony, proposing to raise contribution caps to $7,350 and make them available to all, arguing they foster competition and lower prices by encouraging cost-conscious decisions [73][74][75][76]. In "Restoring Quality Health Care," he emphasizes HSAs as key to market-based reforms [77][78].

Dr. Rand Paul, an ophthalmologist and U.S. Senator, has introduced the Health Savings Accounts for All Act, aiming to decouple HSAs from high-deductible plans, eliminate contribution limits, and extend tax-free benefits to all Americans regardless of income or coverage [79][80][81][82][83][84][85]. His proposals, including in the Obamacare Replacement Act, prioritize flexibility for personalized care.

These ideas build on current expansions, like the 2025 House budget increasing HSA limits, but go further to include non-traditional services [77][74]. With 62% worried about costs, such reforms could gain traction [6].

Table 4 compares systems:

Annual Cost (Family)

Traditional Insurance: $27,000+ premiums

Proposed Universal HSA + Catastrophic: $5,000–$10,000 funding + low premium

Coverage Flexibility

Traditional Insurance: Network-limited

Proposed Universal HSA + Catastrophic: Any provider/service

Administrative Burden

Traditional Insurance: High (claims)

Proposed Universal HSA + Catastrophic: Low (direct pay)

Focus

Traditional Insurance: Acute care

Proposed Universal HSA + Catastrophic: Prevention/wellness

(Source: Derived from proposals by Drs. Atlas and Paul [72][79].)

A Physician's Perspective: Rethinking Care for True Health

With over 20 years practicing spine surgery and caring for thousands of patients, I've witnessed firsthand the limitations of our system. Too often, I've seen individuals deteriorate over time—physically and mentally—despite accessing insured care. This frustration, watching chronic issues worsen amid rising costs, drove me to found Hypercharge Health and Wellness clinics. Our integrative model expands options dramatically, blending evidence-based therapies with personalized wellness strategies that traditional care simply can't match due to time constraints and narrow focus.

I believe we must hybridize: leverage traditional medicine's strengths in acute, major events—like surgeries or injuries—while shifting chronic disease management and everyday wellness to integrative approaches. This is where we're failing Americans most—in preventing illness and addressing vague but debilitating complaints like "I don't feel well." Biohacking and regenerative medicine are game-changers here, offering tools for longevity and quality of life that insurance ignores. A universal HSA system, backstopped by catastrophic coverage, would let patients direct funds to what truly works for them, fostering a healthier nation.

Soaring costs, coverage gaps, and chronic failures demand change. I truly believe that by embracing alternatives and reforms like universal HSAs— we can build a system that prioritizes real wellness.

Bibliography

PeopleKeep. (2025). The Least and Most Expensive States for Health Insurance.

KFF. (2025). ACA Insurers Are Raising Premiums by an Estimated 26%.

KFF. (2025). ACA Marketplace Premium Payments Would More than Double.

KFF. (2025). How Much and Why ACA Marketplace Premiums Are Going Up in 2026.

CNBC. (2025). Health Premiums Rising for Main Street Businesses.

NFIB. (2025). Addressing the Health Insurance Affordability Crisis for Small Businesses.

JPMorgan Chase Institute. (2025). The Consistency of Health Insurance Coverage in Small Businesses.

Peterson-KFF. (2025). How Much and Why Premiums Are Going Up for Small Businesses in 2026.

Mercer. (2025). Employers Prepare for the Highest Health Benefit Cost Increase in 15 Years.

Business Group on Health. (2025). 2026 Employer Health Care Strategy Survey.

Thatch. (2025). Top Health Insurance Trends 2025 for Employers.

Bipartisan Policy Center. (2025). Enhanced Premium Tax Credits.

eHealth. (2025). How Much Is Individual Health Insurance in 2025?

NPR. (2025). How These Employees Pay Nothing for Their Insurance Premiums.

American Action Forum. (2020). Chronic Disease in the United States.

Commonwealth Fund. (2023). U.S. Health Care from a Global Perspective.

Pain Specialists Frisco. (2025). Benefits Regenerative Medicine.

Regenerative Medicine Michigan. (2025). Does Insurance Cover.

Grand View Research. (2025). U.S. Complementary and Alternative Medicine Market.

Grand View Research. (2025). U.S. Concierge Medicine Market.

Hoover Institution. (2017). Expanding and Incentivizing Health Savings Accounts.

Wall Street Journal. (2018). Health Savings Accounts for Everyone.

American Action Forum. (2025). Health Savings Empowerment Plan.

American Action Forum. (2025). Health Savings Empowerment Plan.